From project supports, to pipelines & ammonia

21st March 2025

Author: Dr. John Massey

The latest hydrogen auction news this week comes from India, where the “Solar Energy Corporation of India (SECI) has announced the result of its auction under the Strategic Interventions for Green Hydrogen Transition (SIGHT) programme… to select producers for setting up green hydrogen production facilities in India”.

The winning bidders should result in “a total annual production capacity of 450,000 metric tonnes (MT)” of green hydrogen, backed by “a maximum allocated incentive of Rs 22.39 billion” (US$ 258.84).

The facilities “must be commissioned within 36 months from the date of issuance of the letter of award” and their “quoted capacity must remain unchanged for the first three years of commercial operation”. It’s up to the companies involved to decide where the projects are eventually built, but they must “submit quarterly progress reports to SECI, outlining project updates and any delays”.

Four companies were awarded support up to the maximum-allowed 90,000 MT capacity: AM Green Ammonia India, Waaree Clean Energy Solutions, Green Infra Renewable Energy Farms and L&T Energy Green Tech. Next down in scale were Reliance Green Hydrogen and Green Chemicals; both at 49,000 MT.

In Australia, the Australian Renewable Energy Agency (ARENA) has decided to dole out even more than SECI, and on just one project.

The project in question is Copenhagen Infrastructure Partners’ (CIP) 1,500 MW Murchison Green Hydrogen Project in Western Australia. It will receive “$814 million in funding” (about US$ 512m) from ARENA’s Hydrogen Headstart Program. This is the first such recipient from Hydrogen Headstart.

That programme is designed to “bridge the current commercial gap in the form of a production credit, meaning funding is only provided once projects are constructed and operational” and is backed by the government to the tune of around $4 billion. The production credits will be paid “over a 10-year operating period”.

When and if that funding gets spent now depends on progress for what is certainly an ambitious project: “up to 1.5 GW of electrolysis and 3,600 tonnes per day of Haber-Bosch ammonia production capacity”. The ammonia is intended for export to buyers outside Australia.

Since the project aims to operate “completely off-grid”, the new infrastructure required doesn’t end there. Also needing to be built will be “approximately 1.2 GW of solar photovoltaic and approximately 1.7 GW of onshore wind new build generation with a 600 MW /1,200 MWh battery energy storage system and water sustainably sourced through a new desalination facility”.

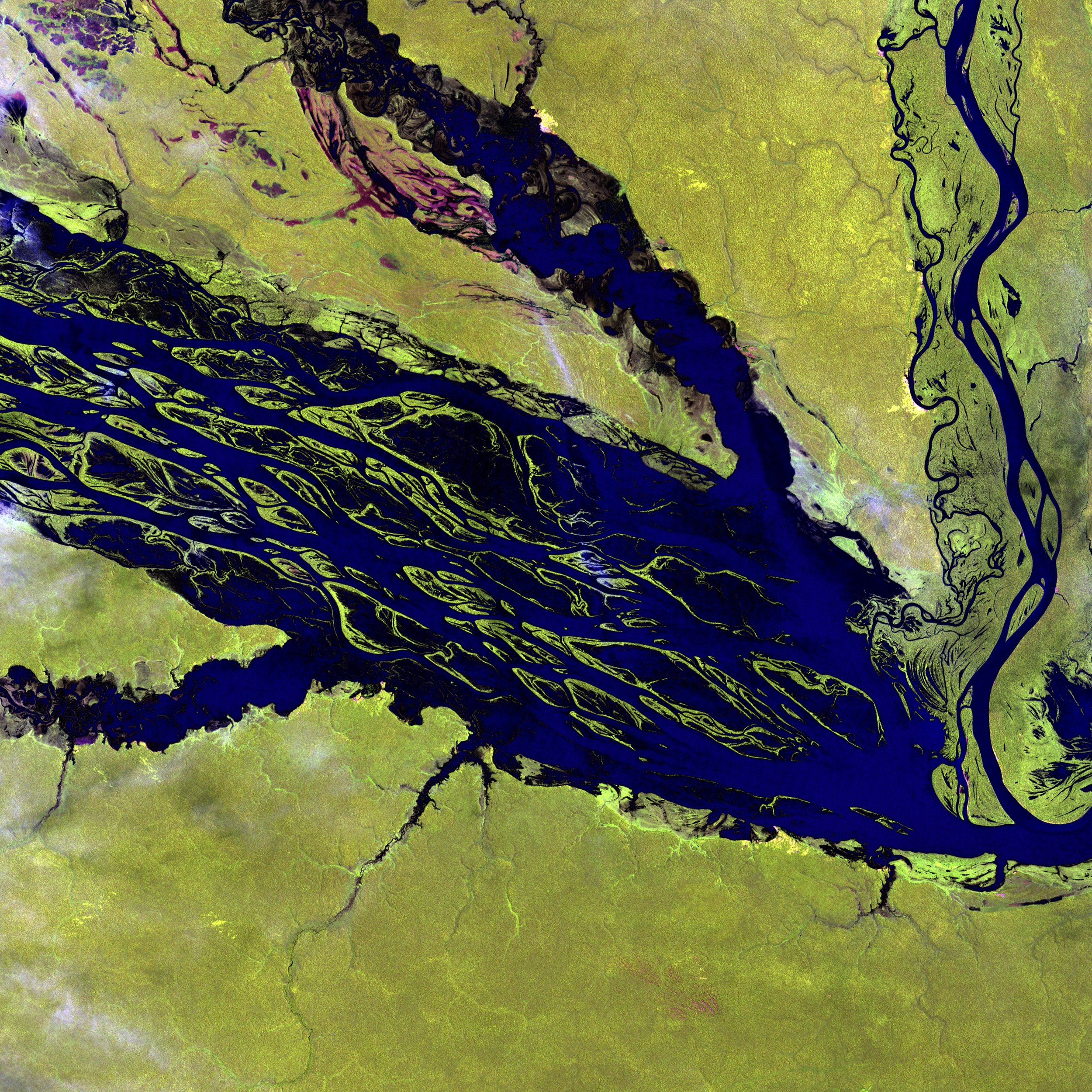

Similarly aiming at giant scale is a green hydrogen and ammonia project planned in Brazil’s Parnaíba Export Processing Zone (EPS) in the state of Piauí, by solar developer Solatio.

To continue reading you must purchase a World Hydrogen Leaders membership

Enjoy more articles like this, over 100 annual online events, regional hydrogen intelligence updates, industry reports, news, and much more.